First off, thanks for open sourcing this work, nicely done! I was super lucky to run into this. I just started a very similar side-project and it looks like I can build a POC of what I have in mind on top of this.

Nice to hear. Do share a link to it here when it is ready :-)

I had some trouble getting started because of parsing issues, and I submitted fixes through a PR. Also, some transaction types are not yet supported, like "Rente" and a few others. I think I'll add those at some point.

Thanks, I saw them. Yes, everything that is currently supported is based on what I've seen in my own account. I didn't have any other data when I wrote it, but I hope I made it such that it shouldn't be too difficult to add other types.

I also plan to look into the currency conversion, because the one used now does not match what is paid through degiro, probably because the bid/ask spread. I do believe it's possible to derive it from the data though.

I think one of the reasons it doesn't match is that I base it on the final value of that day, and not on a particular hour/minute moment on that day. I'm not sure if that data is easily available, but I thought this would be approximate enough to generate useful graphs.

The bigger problem I see is that bank_cash and nominal value don't get calculated correctly

I admit the bank-cash idea might not fit everyone's use case and is something we could also consider removing entirely indeed. My philosophy was that booking money out is never going to happen - unless you temporary put it on your own bank-account to get a higher interest. Eventually that money will go back to the DeGiro account and stock can be bought again. This is of course not true but it did fit my scenario. Do you think there is a bug with the bank-cash implementation or is it just that it doesn't fit your scenario? You should see the red line as DeGiro cash + bank cash.

So I'm OK with removing this concept as you suggested in the code, but now we get issues with the bottom graph showing the relative figures and the benchmarks being less meaningful. Perhaps we can keep the concept of bank-cash for the purposes of the benchmark graphs but just deduct the value from some of the curves in the top graph?

Hey!

First off, thanks for open sourcing this work, nicely done! I was super lucky to run into this. I just started a very similar side-project and it looks like I can build a POC of what I have in mind on top of this. I had some trouble getting started because of parsing issues, and I submitted fixes through a PR. Also, some transaction types are not yet supported, like "Rente" and a few others. I think I'll add those at some point. I also plan to look into the currency conversion, because the one used now does not match what is paid through degiro, probably because the bid/ask spread. I do believe it's possible to derive it from the data though.

The bigger problem I see is that bank_cash and nominal value don't get calculated correctly, and from the code I also don't see how it's intended to work. If you have a degiro account where money goes in and out and back again, the data gets messed up. I was able to get the right data for my use case by using this as deposit code, and not using bank_cash at all.

I can submit it in a PR, but I'll hold off to see if you respond with some more info about the intention.

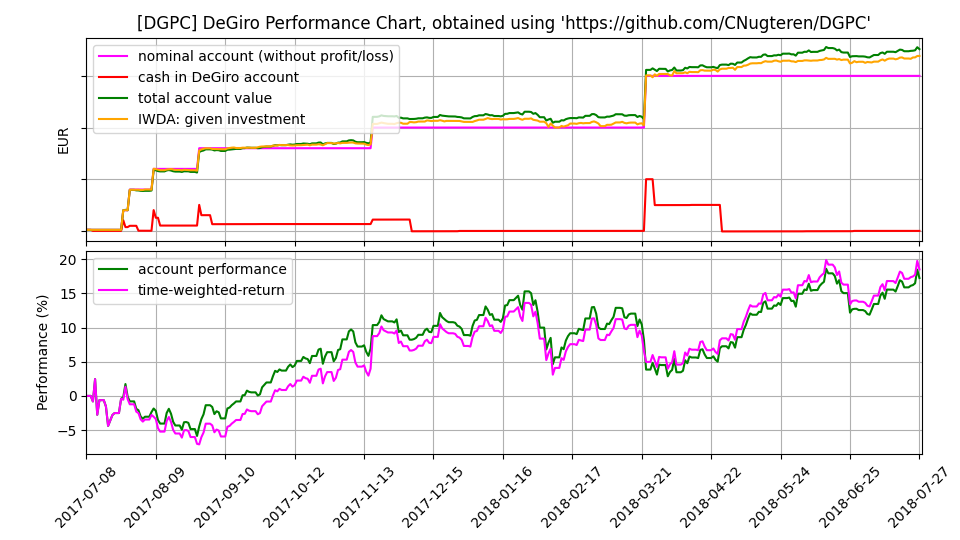

Before the changes

After the changes (this is closer to the correct representation). Ignore the profit/loss line, that's unrelated. Also note that you can see that the performance is number is not valid anymore when you pull money out of the account, because your (unrelized) gain is now relative to a smaller number.

Again, thanks for open sourcing and let me know if you have questions or remarks about the above. Cheers, Erik