Since burnFrom(account, amount) requries approval, there would need to be an extra step beforehand in which the owner of the tokens responds to a permit or approval request. So when a user initiates an interchain transfer in a dapp, the permit or approval call in the web3 (e.g. ethers) code would cause a popup box in the crypto wallet asking for signature (if permit was possible) or an approval transaction. Only when that's passed, the token manager can burn and go on with the rest.

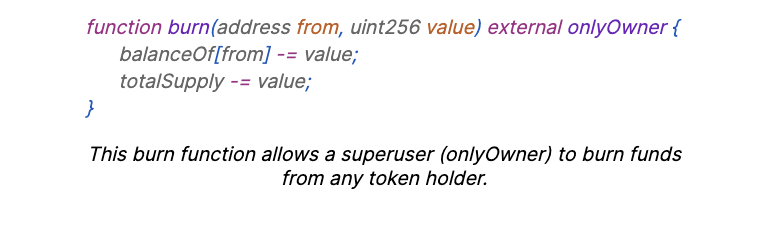

Granting permission to the token manager to freely burn anyone's tokens via

burn(account, amount)makes things easy to code and maintain, but there are risks.There can be a way for an admin (or a hacker who is able to become admin) to freely burn any other holders' tokens. It's better to remove such a risk.

So as further improvement to my suggested interchain token code in https://github.com/axelarnetwork/interchain-token-service/issues/100#issue-1855546703, it'd be much more secure to replace

burn(account, amount)with burnFrom(account, amount) from OpenZeppelin'sERC20Burnableextension.burnFrom(account, amount)requires the owner of the tokens toapproveorpermitsome other account (in this case the token manager) to spend some tokens.So to increase security, the suggestion is to remove

burn(account, amount)andBURNER_ROLE, and addERC20Burnablewhich exportsburnFrom(account, amount).The interchain token sample code would then have code like this:

contract MyInterchainToken is ERC20, ERC20Burnable, AccessControl, ERC20Permit { bytes32 public constant MINTER_ROLE = keccak256("MINTER_ROLE"); using AddressBytesUtils for address; ITokenManager public tokenManager; IInterchainTokenService public service = IInterchainTokenService(0xF786e21509A9D50a9aFD033B5940A2b7D872C208); address public creator; constructor(address adminAddress) ERC20("MyInterchainToken", "MITKN") ERC20Permit("MyInterchainToken") { _grantRole(DEFAULT_ADMIN_ROLE, adminAddress); // Mint 1,000 tokens to the creator creator = adminAddress; _mint(creator, 1000 * 10**decimals()); // Register this token (could also be done 1-time smart contract invocation) // Not a good practice beacuse it can't go to non-EVM chains deployTokenManager(""); } function mint(address to, uint256 amount) public onlyRole(MINTER_ROLE) { _mint(to, amount); } // Removed: function burn(address from, uint256 amount) function deployTokenManager(bytes32 salt) internal { bytes memory params = service.getParamsMintBurn( msg.sender.toBytes(), address(this) ); bytes32 tokenId = service.deployCustomTokenManager( salt, ITokenManagerType.TokenManagerType.MINT_BURN, params ); // tokenManager = ITokenManager(service.getTokenManagerAddress(tokenId)); // transferOwnership(address(tokenManager)); // THIS SHOULD NEVER BE DONE! setTokenManager(service.getTokenManagerAddress(tokenId)); } function myCustomFunction() public { // Just an example custom feature // Give owner 1,000 more _mint(creator, 1000 * 10**18); } /* * Deploy this token, then register it with the Interchain Token Service * You'll be given a TokenManager which you can set here, allowing the * local send methods to function. */ function setTokenManager(address _tokenManager) public onlyRole(DEFAULT_ADMIN_ROLE) { tokenManager = ITokenManager(_tokenManager); _grantRole(MINTER_ROLE, _tokenManager); } /** * @notice Implementation of the interchainTransfer method * @dev We chose to either pass `metadata` as raw data on a remote contract call, or, if no data is passed, just do a transfer. * A different implementation could have `metadata` that tells this function which function to use or that it is used for anything else as well. * @param destinationChain The destination chain identifier. * @param recipient The bytes representation of the address of the recipient. * @param amount The amount of token to be transfered. * @param metadata Either empty, to just facilitate an interchain transfer, or the data can be passed for an interchain contract call with transfer as per semantics defined by the token service. */ function interchainTransfer( string calldata destinationChain, bytes calldata recipient, uint256 amount, bytes calldata metadata ) external payable { address sender = msg.sender; // Metadata semantics are defined by the token service and thus should be passed as-is. tokenManager.transmitInterchainTransfer{value: msg.value}( sender, destinationChain, recipient, amount, metadata ); } /** * @notice Implementation of the interchainTransferFrom method * @dev We chose to either pass `metadata` as raw data on a remote contract call, or, if no data is passed, just do a transfer. * A different implementation could have `metadata` that tells this function which function to use or that it is used for anything else as well. * @param sender the sender of the tokens. They need to have approved `msg.sender` before this is called. * @param destinationChain the string representation of the destination chain. * @param recipient the bytes representation of the address of the recipient. * @param amount the amount of token to be transfered. * @param metadata either empty, to just facilitate a cross-chain transfer, or the data to be passed to a cross-chain contract call and transfer. */ function interchainTransferFrom( address sender, string calldata destinationChain, bytes calldata recipient, uint256 amount, bytes calldata metadata ) external payable { uint256 _allowance = allowance(sender, msg.sender); if (_allowance != type(uint256).max) { _approve(sender, msg.sender, _allowance - amount); } tokenManager.transmitInterchainTransfer{value: msg.value}( sender, destinationChain, recipient, amount, metadata ); } }