Team's Response

We have consciously decided to only allow 1 meeting per client at any time, since clients typically only schedule 1 meeting in advance (as per consultation with an actual insurance agent). This "bug" is more of a feature suggestion. It does not degrade the usefulness of the product within the intended scope.

Besides, if the insurance agent was fully booked for 3 months, it does not matter whether the app allowed multiple meetings per client, so your premise is invalid.

Items for the Tester to Verify

:question: Issue response

Team chose [response.NotInScope]

- [x] I disagree

Reason for disagreement: # Why this bug is in scope

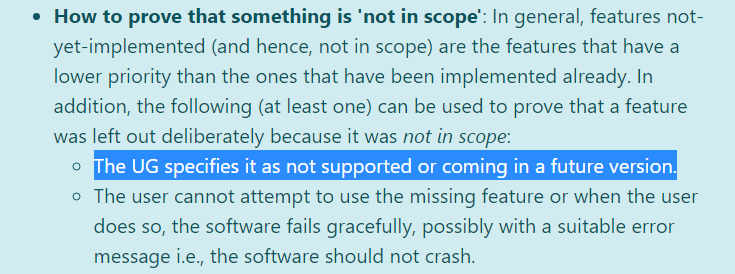

A relevant paragraph from the textbook:

For The UG has to specify that this features are not in scope. The team’s UG did not specify so, ie. there was no indication that the intention of the team was to only allow 1 meeting (as per what they have said)

since clients typically only schedule 1 meeting in advance (as per consultation with an actual insurance agent)

Therefore, the issue is still in scope.

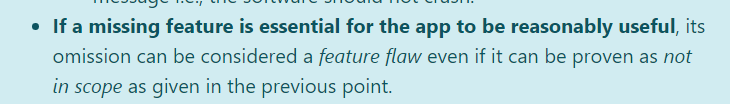

Even if it was Not In Scope:

Even if it could be proven to be Not in Scope,

Let me elaborate on why more than 1 meeting per client is essential.

Insurance agents do require multiple appointments to sell a plan to the client

I mentioned that insurance agents typically receive multiple appointments from a client. The team seems to have rejected that logic, by saying:

clients typically only schedule 1 meeting in advance

This is not true. Since this pertains more to the actual workings of the insurance industry, and not about the actual module details, I shall not go too deeply into this, and offer a concise description.

- Often, clients make an appointment to discuss their needs and wants (often called a Financial Needs Analysis (FNA)).

- Then, another appointment would have to be made to obtain different options that the client may want to pursue, as the insurance agent would have to take time to think of the best plan for the client. This actually takes some time, as there are many insurance products out there. A quick look at AIA's website would surface 10 different insurance categories alone. Depending on the client's needs and wants, the insurance agent will have to sort through the potentially hundreds of different products, to sell the right one. This is not something that can be done within the appointment itself, since there is a lot of documents that the insurance agent is legally bound to give and explain to the client.

- Furthermore, after the insurance plan is "sold" to the client, there typically needs to be further appointments to settle the paperwork.

- Also, there exists a "14 day free-look period" for life insurance/accident and health policies, where clients can review the policy to see if it suits their needs. Within these 14 days, clients can cancel their policy without any penalties. This is a legal requirement, as stated in Singapore Statutes: Insurance (General Provisions) Regulations, Section 8(1)(a) It would be reasonable that in the case where an insurance agent has a packed schedule, to book 2 appointments 14 days apart, the first to confirm the "sale" of the insurance product, and the second to confirm that the client does not want to terminate their insurance product.

- Lastly, the insurance agent will need to hold regular review sessions with the client, to understand the client's financial situation and to see if anything has changed.

EVEN if the insurance product is not a life insurance/accident and health policy (which is a large proportion of all policies sold through insurance agents, and is also a common policy sold), and can be sold in 1 appointment with a financial needs analysis done on the spot with documentation produced, , the app does not support recurring sessions with the clients, which, as mentioned, is required when selling an insurance product.

Therefore, this is a feature flaw, because it would not otherwise be usable for insurance agents requiring multiple meetings with the same client in a short period of time.

Team mentions that premise is invalid

Besides, if the insurance agent was fully booked for 3 months, it does not matter whether the app allowed multiple meetings per client, so your premise is invalid.

My "premise", as the group has put it, is that if the insurance agent was fully booked for 3 months, a potential client would be able to book multiple meetings 3 months in advance, instead of having to to book only 1 meeting 3 months in advance, then booking another one 3 months later after this meeting had lapsed.

In the former case, 2 meetings with the same client can be held 1 day apart, 3 months later.

- Total waiting time for client for 2 meetings: 3 months and one day In the latter case, every meeting with the same client has to be 3 months apart.

- Total waiting time for client for 2 meetings: 3 months + 3 months = 6 months

3 Months may be an exaggeration, but one could see how this would apply for an insurance agent that is fully booked for 1 month, or even just 1-2 weeks.

clearly, it MATTERS whether the app allowed multiple meetings per client. The team's logic in invalidating the premise is flawed, speaking of a lack of understanding of the underlying problem, and have instead wrongly classified this as not in scope.

as mentioned in the UG,

This does not seem to fit with the general idea of making appointment for insurance meetings, since the client or the insurance agent may want to make several appointments in advance.

If an insurance agent was really popular and had many appointments such that they would almost always be fully booked for the next 3 months, any one wanting to book an appointment would have to wait for 3 months AFTER their last appointment to book again. If the client wanted to perhaps take a week to consider the plans and get back to the agent, they would have to wait 3 months as well.

Therefore, the feature is incomplete.