Python APIs for SAS Online Alpha Trade Web Platform

MAJOR CHANGES : NEW VERSION 1.0.0

API endpoints are changed to match the new ones, bugs expected

- Removed check for enabled exchanges, you can now download or search symbols from MCX as well if it is not enabled

- TOTP SECRET or TOTP both can be given as argument while creating AlphaTrade object (if it is 6 digits it will conside TOTP else TOTP SECRET)

- Added new search function to search scrips which will return json for found scrips, you need to process it further

- More functions to come.

- Check whether streaming websocket is working or not

- The

examplesfolder is removed and examples are renamed and kept in root directory for ease of development

STEPS to work

- Clone the repo locally -

git clone https://github.com/algo2t/alphatrade.git - Create a virtualenv -

python -m pip install virtualenvand thenpython -m virtualenv venvand activate thevenvenvironment. - Install dev-requirement.txt -

python -m pip install -r dev-requirements.txt- this is to ensuresetuptools==57.5.0is installed. There is a bug withprotlib, target is to get reed ofprotlibin future - Install requirement.txt -

python -m pip install -r requirement.txt - Create the

config.pyfile in root of cloned repo withlogin_id,passwordandTOTPSECRET, you can add theaccess_token.txtif you want to use existingaccess_token. - Try the examples

python zlogin_example.py,python zexample_sas_login.py,python zhistorical_data.pyandpython zstreaming_data.py - Expecting issues with the streaming data !!! :P

NOTE:: This is Unofficial python module, don't ask SAS support team for help, use it AS-IS

The Python APIs for communicating with the SAS Online Alpha Trade Web Platform.

Alpha Trade Python library provides an easy to use python wrapper over the HTTPS APIs.

The HTTP calls have been converted to methods and JSON responses are wrapped into Python-compatible objects.

Websocket connections are handled automatically within the library.

This work is completely based on Python SDK / APIs for AliceBlueOnline.

Thanks to krishnavelu.

- Author: algo2t

- Github Repository: alphatrade

Installation

This module is installed via pip:

pip install git+https://github.com/algo2t/alphatrade.gitIt can also be installed from pypi

pip install alphatradeTo force upgrade existing installations:

pip uninstall alphatrade

pip --no-cache-dir install --upgrade alphatradePrerequisites

Python 3.x

Make sure to install setuptools==57.5.0 for protlib==1.5.0 to work properly

Also, you need the following modules:

setuptools==57.5.0protlib==1.5.0websocket-client==1.6.1requests==2.31.0pandas==2.0.3pyotp==2.8.0

The modules can also be installed using pip

Examples - Start Here - Important

Please clone this repository and check the examples folder to get started.

Check here

Getting started with API

Overview

There is only one class in the whole library: AlphaTrade. When the AlphaTrade object is created an access token from the SAS Online alpha trade server is stored in text file access_token.txt in the same directory. An access token is valid for 24 hours. See the examples folder with config.py file to see how to store your credentials.

With an access token, you can instantiate an AlphaTrade object again. Ideally you only need to create an access_token once every day.

REST Documentation

The original REST API that this SDK is based on is available online. Tradelabs API documentation

Using the API

Logging

The whole library is equipped with python‘s logging module for debugging. If more debug information is needed, enable logging using the following code.

import logging

logging.basicConfig(level=logging.DEBUG)Get an access token

- Import alphatrade

from alphatrade import *- Create

config.pyfile

Always keep credentials in a separate filelogin_id = "XXXXX" password = "XXXXXXXX" Totp = 'XXXXXXXXXXXXXXXX'

try: access_token = open('access_token.txt', 'r').read().rstrip() except Exception as e: print('Exception occurred :: {}'.format(e)) access_token = None

3. Import the config

```python

import configCreate AlphaTrade Object

- Create

AlphaTradeobject with yourlogin_id,password,TOTP/TOTP_SECRETand/oraccess_token.

Use config object to get login_id, password, TOTP and access_token.

from alphatrade import AlphaTrade

import config

import pyotp

Totp = config.Totp

pin = pyotp.TOTP(Totp).now()

totp = f"{int(pin):06d}" if len(pin) <=5 else pin

sas = AlphaTrade(login_id=config.login_id, password=config.password, twofa=totp, access_token=config.access_token)

OR

## filename config.py

login_id = "RR24XX"

password = "SuperSecretPassword!!!"

TOTP_SECRET = 'YOURTOTPSECRETEXTERNALAUTH'

try:

access_token = open('access_token.txt', 'r').read().rstrip()

except Exception as e:

print(f'Exception occurred :: {e}')

access_token = None

from alphatrade import AlphaTrade

import config

import pyotp

sas = AlphaTrade(login_id=config.login_id, password=config.password, twofa=config.TOTP_SECRET, access_token=config.access_token)

- You can run commands here to check your connectivity

print(sas.get_balance()) # get balance / margin limits

print(sas.get_profile()) # get profile

print(sas.get_daywise_positions()) # get daywise positions

print(sas.get_netwise_positions()) # get netwise positions

print(sas.get_holding_positions()) # get holding positionsGet master contracts

Getting master contracts allow you to search for instruments by symbol name and place orders.

Master contracts are stored as an OrderedDict by token number and by symbol name. Whenever you get a trade update, order update, or quote update, the library will check if master contracts are loaded. If they are, it will attach the instrument object directly to the update. By default all master contracts of all enabled exchanges in your personal profile will be downloaded. i.e. If your profile contains the following as enabled exchanges ['NSE', 'BSE', 'CDS', 'MCX', NFO'] all contract notes of all exchanges will be downloaded by default. If you feel it takes too much time to download all exchange, or if you don‘t need all exchanges to be downloaded, you can specify which exchange to download contract notes while creating the AlphaTrade object.

sas = AlphaTrade(login_id=config.login_id, password=config.password, twofa=totp, access_token=config.access_token, master_contracts_to_download=['NSE', 'BSE'])This will reduce a few milliseconds in object creation time of AlphaTrade object.

Get tradable instruments

Symbols can be retrieved in multiple ways. Once you have the master contract loaded for an exchange, you can get an instrument in many ways.

Get a single instrument by it‘s name:

tatasteel_nse_eq = sas.get_instrument_by_symbol('NSE', 'TATASTEEL')

reliance_nse_eq = sas.get_instrument_by_symbol('NSE', 'RELIANCE')

ongc_bse_eq = sas.get_instrument_by_symbol('BSE', 'ONGC')

india_vix_nse_index = sas.get_instrument_by_symbol('NSE', 'India VIX')

sensex_nse_index = sas.get_instrument_by_symbol('BSE', 'SENSEX')Get a single instrument by it‘s token number (generally useful only for BSE Equities):

ongc_bse_eq = sas.get_instrument_by_token('BSE', 500312)

reliance_bse_eq = sas.get_instrument_by_token('BSE', 500325)

acc_nse_eq = sas.get_instrument_by_token('NSE', 22)Get FNO instruments easily by mentioning expiry, strike & call or put.

bn_fut = sas.get_instrument_for_fno(symbol = 'BANKNIFTY', expiry_date=datetime.date(2019, 6, 27), is_fut=True, strike=None, is_call = False)

bn_call = sas.get_instrument_for_fno(symbol = 'BANKNIFTY', expiry_date=datetime.date(2019, 6, 27), is_fut=False, strike=30000, is_call = True)

bn_put = sas.get_instrument_for_fno(symbol = 'BANKNIFTY', expiry_date=datetime.date(2019, 6, 27), is_fut=False, strike=30000, is_call = False)Search for symbols

Search for multiple instruments by matching the name. This works case insensitive and returns all instrument which has the name in its symbol.

all_sensex_scrips = sas.search_instruments('BSE', 'sEnSeX')

print(all_sensex_scrips)The above code results multiple symbol which has ‘sensex’ in its symbol.

[Instrument(exchange='BSE', token=1, symbol='SENSEX', name='SENSEX', expiry=None, lot_size=None), Instrument(exchange='BSE', token=540154, symbol='IDFSENSEXE B', name='IDFC Mutual Fund', expiry=None, lot_size=None), Instrument(exchange='BSE', token=532985, symbol='KTKSENSEX B', name='KOTAK MAHINDRA MUTUAL FUND', expiry=None, lot_size=None), Instrument(exchange='BSE', token=538683, symbol='NETFSENSEX B', name='NIPPON INDIA ETF SENSEX', expiry=None, lot_size=None), Instrument(exchange='BSE', token=535276, symbol='SBISENSEX B', name='SBI MUTUAL FUND - SBI ETF SENS', expiry=None, lot_size=None)]Search for multiple instruments by matching multiple names

multiple_underlying = ['BANKNIFTY','NIFTY','INFY','BHEL']

all_scripts = sas.search_instruments('NFO', multiple_underlying)Instrument object

Instruments are represented by instrument objects. These are named-tuples that are created while getting the master contracts. They are used when placing an order and searching for an instrument. The structure of an instrument tuple is as follows:

Instrument = namedtuple('Instrument', ['exchange', 'token', 'symbol',

'name', 'expiry', 'lot_size'])All instruments have the fields mentioned above. Wherever a field is not applicable for an instrument (for example, equity instruments don‘t have strike prices), that value will be None

Quote update

Once you have master contracts loaded, you can easily subscribe to quote updates.

Four types of feed data are available

You can subscribe any one type of quote update for a given scrip. Using the LiveFeedType enum, you can specify what type of live feed you need.

LiveFeedType.MARKET_DATALiveFeedType.COMPACTLiveFeedType.SNAPQUOTELiveFeedType.FULL_SNAPQUOTE

Please refer to the original documentation here for more details of different types of quote update.

Subscribe to a live feed

sas.subscribe(sas.get_instrument_by_symbol('NSE', 'TATASTEEL'), LiveFeedType.MARKET_DATA)

sas.subscribe(sas.get_instrument_by_symbol('BSE', 'RELIANCE'), LiveFeedType.COMPACT)Subscribe to multiple instruments in a single call. Give an array of instruments to be subscribed.

sas.subscribe([sas.get_instrument_by_symbol('NSE', 'TATASTEEL'), sas.get_instrument_by_symbol('NSE', 'ACC')], LiveFeedType.MARKET_DATA)Note: There is a limit of 250 scrips that can be subscribed on total. Beyond this point the server may disconnect web-socket connection.

Start getting live feed via socket

socket_opened = False

def event_handler_quote_update(message):

print(f"quote update {message}")

def open_callback():

global socket_opened

socket_opened = True

sas.start_websocket(subscribe_callback=event_handler_quote_update,

socket_open_callback=open_callback,

run_in_background=True)

while(socket_opened==False):

pass

sas.subscribe(sas.get_instrument_by_symbol('NSE', 'ONGC'), LiveFeedType.MARKET_DATA)

sleep(10)Unsubscribe to a live feed

Unsubscribe to an existing live feed

sas.unsubscribe(sas.get_instrument_by_symbol('NSE', 'TATASTEEL'), LiveFeedType.MARKET_DATA)

sas.unsubscribe(sas.get_instrument_by_symbol('BSE', 'RELIANCE'), LiveFeedType.COMPACT)Unsubscribe to multiple instruments in a single call. Give an array of instruments to be unsubscribed.

sas.unsubscribe([sas.get_instrument_by_symbol('NSE', 'TATASTEEL'), sas.get_instrument_by_symbol('NSE', 'ACC')], LiveFeedType.MARKET_DATA)Get All Subscribed Symbols

sas.get_all_subscriptions() # AllMarket Status messages & Exchange messages.

Subscribe to market status messages

sas.subscribe_market_status_messages()Getting market status messages.

print(sas.get_market_status_messages())Example result of get_market_status_messages()

[{'exchange': 'NSE', 'length_of_market_type': 6, 'market_type': b'NORMAL', 'length_of_status': 31, 'status': b'The Closing Session has closed.'}, {'exchange': 'NFO', 'length_of_market_type': 6, 'market_type': b'NORMAL', 'length_of_status': 45, 'status': b'The Normal market has closed for 22 MAY 2020.'}, {'exchange': 'CDS', 'length_of_market_type': 6, 'market_type': b'NORMAL', 'length_of_status': 45, 'status': b'The Normal market has closed for 22 MAY 2020.'}, {'exchange': 'BSE', 'length_of_market_type': 13, 'market_type': b'OTHER SESSION', 'length_of_status': 0, 'status': b''}]Note: As per alice blue documentation all market status messages should be having a timestamp. But in actual the server doesn‘t send timestamp, so the library is unable to get timestamp for now.

Subscribe to exchange messages

sas.subscribe_exchange_messages()Getting market status messages.

print(sas.get_exchange_messages())Example result of get_exchange_messages()

[{'exchange': 'NSE', 'length': 32, 'message': b'DS : Bulk upload can be started.', 'exchange_time_stamp': 1590148595}, {'exchange': 'NFO', 'length': 200, 'message': b'MARKET WIDE LIMIT FOR VEDL IS 183919959. OPEN POSITIONS IN VEDL HAVE REACHED 84 PERCENT OF THE MARKET WIDE LIMIT. ', 'exchange_time_stamp': 1590146132}, {'exchange': 'CDS', 'length': 54, 'message': b'DS : Regular segment Bhav copy broadcast successfully.', 'exchange_time_stamp': 1590148932}, {'exchange': 'MCX', 'length': 7, 'message': b'.......', 'exchange_time_stamp': 1590196159}]Market Status messages & Exchange messages through callbacks

socket_opened = False

def market_status_messages(message):

print(f"market status messages {message}")

def exchange_messages(message):

print(f"exchange messages {message}")

def open_callback():

global socket_opened

socket_opened = True

sas.start_websocket(market_status_messages_callback=market_status_messages,

exchange_messages_callback=exchange_messages,

socket_open_callback=open_callback,

run_in_background=True)

while(socket_opened==False):

pass

sas.subscribe_market_status_messages()

sas.subscribe_exchange_messages()

sleep(10)Place an order

Place limit, market, SL, SL-M, AMO, BO, CO orders

print (sas.get_profile())

# TransactionType.Buy, OrderType.Market, ProductType.Delivery

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%1%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.Market,

product_type = ProductType.Delivery,

price = 0.0,

trigger_price = None,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.Market, ProductType.Intraday

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%2%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.Market,

product_type = ProductType.Intraday,

price = 0.0,

trigger_price = None,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.Market, ProductType.CoverOrder

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%3%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.Market,

product_type = ProductType.CoverOrder,

price = 0.0,

trigger_price = 7.5, # trigger_price Here the trigger_price is taken as stop loss (provide stop loss in actual amount)

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.Limit, ProductType.BracketOrder

# OCO Order can't be of type market

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%4%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.Limit,

product_type = ProductType.BracketOrder,

price = 8.0,

trigger_price = None,

stop_loss = 6.0,

square_off = 10.0,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.Limit, ProductType.Intraday

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%5%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.Limit,

product_type = ProductType.Intraday,

price = 8.0,

trigger_price = None,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.Limit, ProductType.CoverOrder

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%6%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.Limit,

product_type = ProductType.CoverOrder,

price = 7.0,

trigger_price = 6.5, # trigger_price Here the trigger_price is taken as stop loss (provide stop loss in actual amount)

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

###############################

# TransactionType.Buy, OrderType.StopLossMarket, ProductType.Delivery

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%7%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.StopLossMarket,

product_type = ProductType.Delivery,

price = 0.0,

trigger_price = 8.0,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.StopLossMarket, ProductType.Intraday

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%8%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.StopLossMarket,

product_type = ProductType.Intraday,

price = 0.0,

trigger_price = 8.0,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.StopLossMarket, ProductType.CoverOrder

# CO order is of type Limit and And Market Only

# TransactionType.Buy, OrderType.StopLossMarket, ProductType.BO

# BO order is of type Limit and And Market Only

###################################

# TransactionType.Buy, OrderType.StopLossLimit, ProductType.Delivery

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%9%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.StopLossMarket,

product_type = ProductType.Delivery,

price = 8.0,

trigger_price = 8.0,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.StopLossLimit, ProductType.Intraday

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%10%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.StopLossLimit,

product_type = ProductType.Intraday,

price = 8.0,

trigger_price = 8.0,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.StopLossLimit, ProductType.CoverOrder

# CO order is of type Limit and And Market Only

# TransactionType.Buy, OrderType.StopLossLimit, ProductType.BracketOrder

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%11%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.StopLossLimit,

product_type = ProductType.BracketOrder,

price = 8.0,

trigger_price = 8.0,

stop_loss = 1.0,

square_off = 1.0,

trailing_sl = 20,

is_amo = False)

)Place basket order

Basket order is used to buy or sell group of securities simultaneously.

order1 = { "instrument" : sas.get_instrument_by_symbol('NSE', 'INFY'),

"order_type" : OrderType.Market,

"quantity" : 1,

"transaction_type" : TransactionType.Buy,

"product_type" : ProductType.Delivery}

order2 = { "instrument" : sas.get_instrument_by_symbol('NSE', 'SBIN'),

"order_type" : OrderType.Limit,

"quantity" : 2,

"price" : 280.0,

"transaction_type" : TransactionType.Sell,

"product_type" : ProductType.Intraday}

order = [order1, order2]

print(sas.place_basket_order(orders))Cancel an order

sas.cancel_order('170713000075481') #Cancel an open orderGetting order history and trade details

Get order history of a particular order

print(sas.get_order_history('170713000075481'))Get order history of all orders.

print(sas.get_order_history())Get trade book

print(sas.get_trade_book())Get historical candles data

This will provide historical data but not for current day.

This returns a pandas DataFrame object which be used with pandas_ta to get various indicators values.

from datetime import datetime

print(sas.get_historical_candles('MCX', 'NATURALGAS NOV FUT', datetime(2020, 10, 19), datetime.now() ,interval=30))Output

Instrument(exchange='MCX', token=224365, symbol='NATURALGAS NOV FUT', name='', expiry=datetime.date(2020, 11, 24), lot_size=None)

open high low close volume

date

2020-10-19 09:00:00+05:30 238.9 239.2 238.4 239.0 373

2020-10-19 09:30:00+05:30 239.0 239.0 238.4 238.6 210

2020-10-19 10:00:00+05:30 238.7 238.7 238.1 238.1 213

2020-10-19 10:30:00+05:30 238.0 238.4 238.0 238.1 116

2020-10-19 11:00:00+05:30 238.1 238.2 238.0 238.0 69

... ... ... ... ... ...

2020-10-23 21:00:00+05:30 237.5 238.1 237.3 237.6 331

2020-10-23 21:30:00+05:30 237.6 238.5 237.6 237.9 754

2020-10-23 22:00:00+05:30 237.9 238.1 237.2 237.9 518

2020-10-23 22:30:00+05:30 237.9 238.7 237.7 238.1 897

2020-10-23 23:00:00+05:30 238.2 238.3 236.3 236.5 1906

Better way to get historical data, first get the latest version from github

python -m pip install git+https://github.com/algo2t/alphatrade.git

from datetime import datetime

india_vix_nse_index = sas.get_instrument_by_symbol('NSE', 'India VIX')

print(sas.get_historical_candles(india_vix_nse_index.exchange, india_vix_nse_index.symbol, datetime(2020, 10, 19), datetime.now() ,interval=30))Get intraday candles data

This will give candles data for current day only.

This returns a pandas DataFrame object which be used with pandas_ta to get various indicators values.

print(sas.get_intraday_candles('MCX', 'NATURALGAS NOV FUT', interval=15))Better way to get intraday data, first get the latest version from github

python -m pip install git+https://github.com/algo2t/alphatrade.git

from datetime import datetime

nifty_bank_nse_index = sas.get_instrument_by_symbol('NSE', 'Nifty Bank')

print(sas.get_intraday_candles(nifty_bank_nse_index.exchange, nifty_bank_nse_index.symbol, datetime(2020, 10, 19), datetime.now(), interval=10))Order properties as enums

Order properties such as TransactionType, OrderType, and others have been safely classified as enums so you don‘t have to write them out as strings

TransactionType

Transaction types indicate whether you want to buy or sell. Valid transaction types are of the following:

TransactionType.Buy- buyTransactionType.Sell- sell

OrderType

Order type specifies the type of order you want to send. Valid order types include:

OrderType.Market- Place the order with a market priceOrderType.Limit- Place the order with a limit price (limit price parameter is mandatory)OrderType.StopLossLimit- Place as a stop loss limit orderOrderType.StopLossMarket- Place as a stop loss market order

ProductType

Product types indicate the complexity of the order you want to place. Valid product types are:

ProductType.Intraday- Intraday order that will get squared off before market closeProductType.Delivery- Delivery order that will be held with you after market closeProductType.CoverOrder- Cover orderProductType.BracketOrder- One cancels other order. Also known as bracket order

Working with examples

Here, examples directory there are 3 files zlogin_example.py, zstreaming_data.py and stop.txt

Steps

- Clone the repository to your local machine

git clone https://github.com/algo2t/alphatrade.git - Copy the examples directory to any location where you want to write your code

- Install the

alphatrademodule usingpip=>python -m pip install https://github.com/algo2t/alphatrade.git - Open the examples directory in your favorite editor, in our case it is VSCodium

- Open the

zlogin_example.pyfile in the editor - Now, create

config.pyfile as per instructions given below and in the above file - Provide correct login credentials like login_id, password and 16 digit totp code (find below qr code)

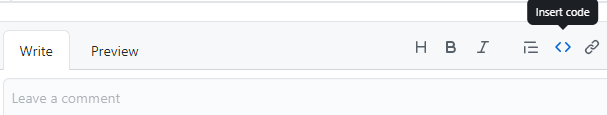

- This is generally set from the homepage of alpha web trading platform here

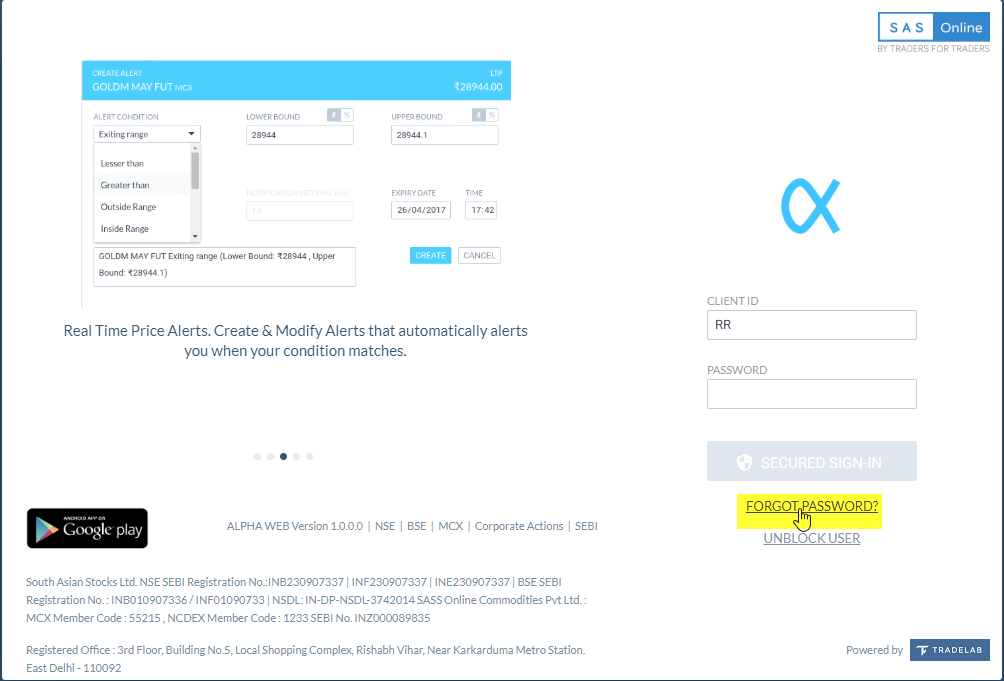

- Click on

FORGET PASSWORD?=> SelectReset 2FAradio button.

- Enter the CLIENT ID (LOGIN_ID), EMAIL ID and PAN NUMBER, click on

RESETbutton.

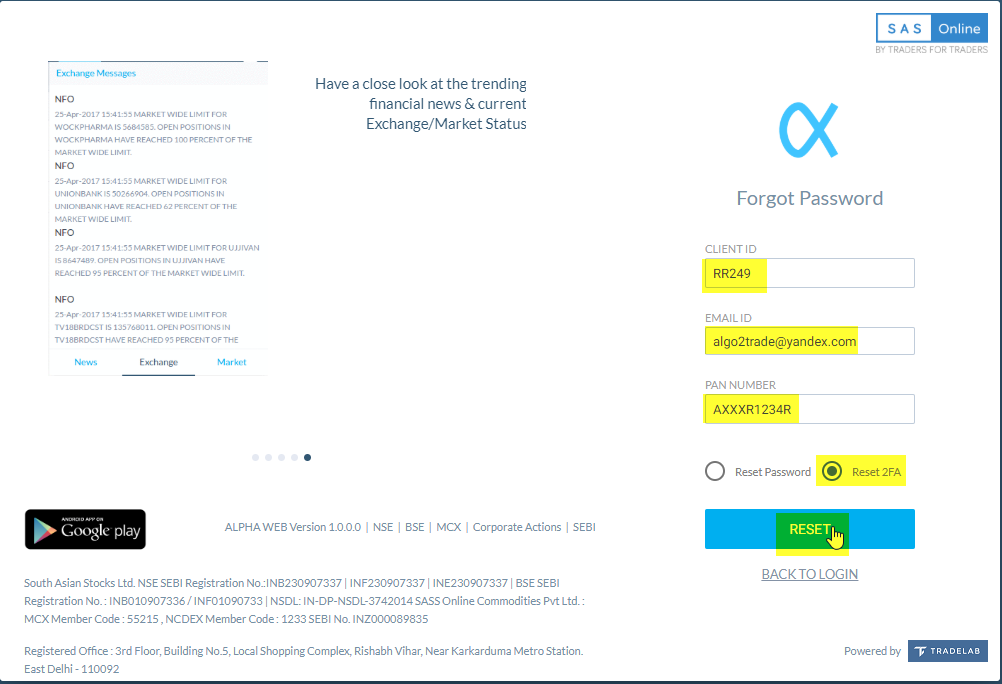

- Click on

BACK TO LOGINand enterCLIENT IDandPASSWORD, click onSECURED SIGN-IN - Set same answers for 5 questions and click on

SUBMITbutton.

config.py

login_id = "XXXXX"

password = "XXXXXXXX"

Totp = 'XXXXXXXXXXXXXXXX'

try:

access_token = open('access_token.txt', 'r').read().rstrip()

except Exception as e:

print('Exception occurred :: {}'.format(e))

access_token = NoneExample strategy using alpha trade API

Here is an example moving average strategy using alpha trade web API. This strategy generates a buy signal when 5-EMA > 20-EMA (golden cross) or a sell signal when 5-EMA < 20-EMA (death cross).

Example for getting historical and intraday candles data

Here is an example for getting historical data using alpha trade web API.

For historical candles data start_time and end_time must be provided in format as shown below.

It can also be provided as timedelta. Check the script zhistorical_data.py in examples.

from datetime import datetime, timedelta

start_time = datetime(2020, 10, 19, 9, 15, 0)

end_time = datetime(2020, 10, 21, 16, 59, 0)

df = sas.get_historical_candles('MCX', 'NATURALGAS OCT FUT', start_time, end_time, 5)

print(df)

end_time = start_time + timedelta(days=5)

df = sas.get_historical_candles('MCX', 'NATURALGAS NOV FUT', start_time, end_time, 15)

print(df)For intraday or today‘s / current day‘s candles data.

df = sas.get_intraday_candles('MCX', 'NATURALGAS OCT FUT')

print(df)

df = sas.get_intraday_candles('MCX', 'NATURALGAS NOV FUT', 15)

print(df)Read this before creating an issue

Before creating an issue in this library, please follow the following steps.

- Search the problem you are facing is already asked by someone else. There might be some issues already there, either solved/unsolved related to your problem. Go to issues page, use

is:issueas filter and search your problem.

- If you feel your problem is not asked by anyone or no issues are related to your problem, then create a new issue.

- Describe your problem in detail while creating the issue. If you don‘t have time to detail/describe the problem you are facing, assume that I also won‘t be having time to respond to your problem.

- Post a sample code of the problem you are facing. If I copy paste the code directly from issue, I should be able to reproduce the problem you are facing.

- Before posting the sample code, test your sample code yourself once. Only sample code should be tested, no other addition should be there while you are testing.

- Have some print() function calls to display the values of some variables related to your problem.

- Post the results of print() functions also in the issue.

- Use the insert code feature of github to inset code and print outputs, so that the code is displayed neat.