The origin of ZVT

The Three Major Principles of Stock Trading

Read this in other languages: 中文.

Read the docs:https://zvt.readthedocs.io/en/latest/

Install

python3 -m pip install -U zvtMain ui

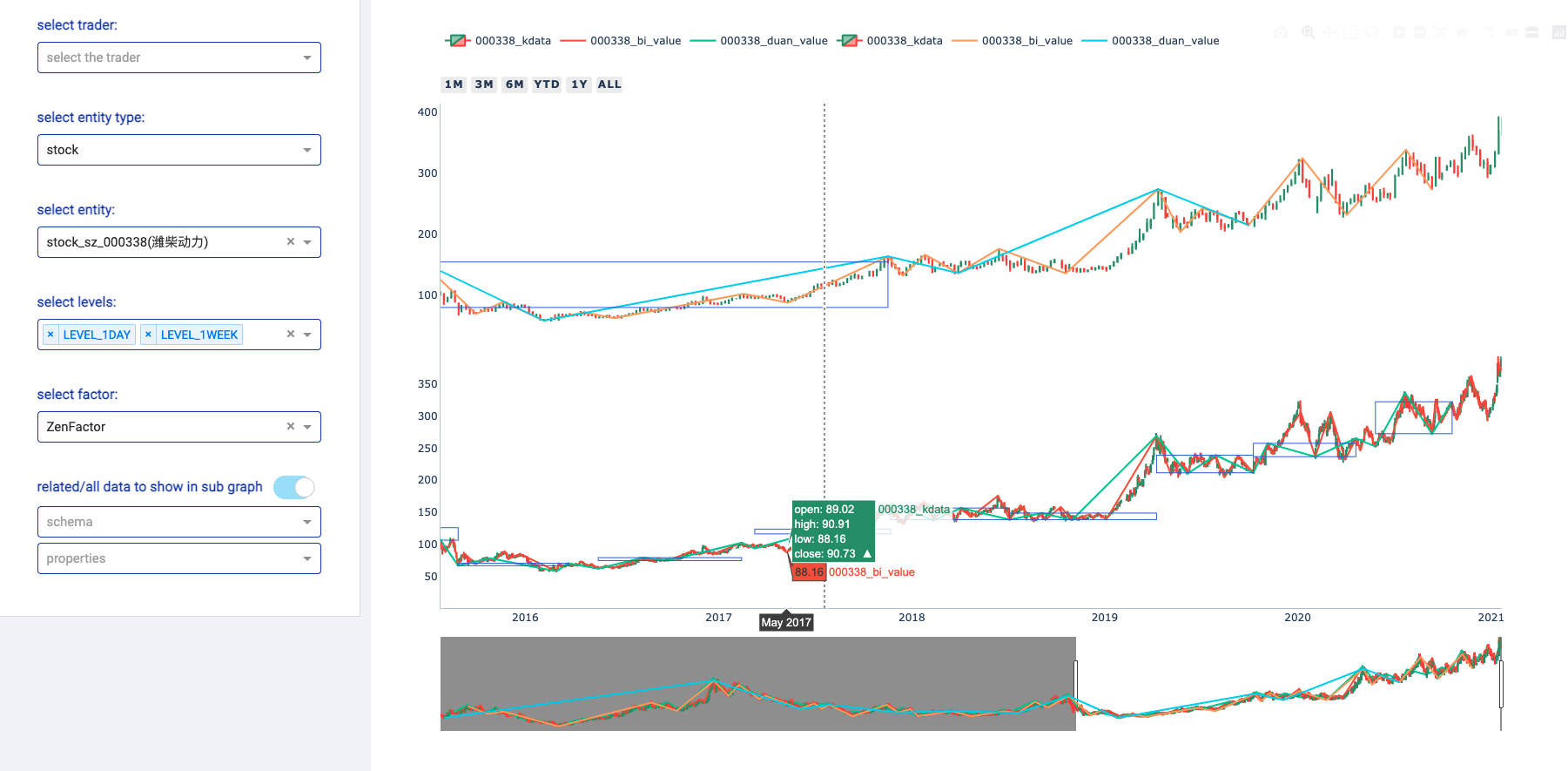

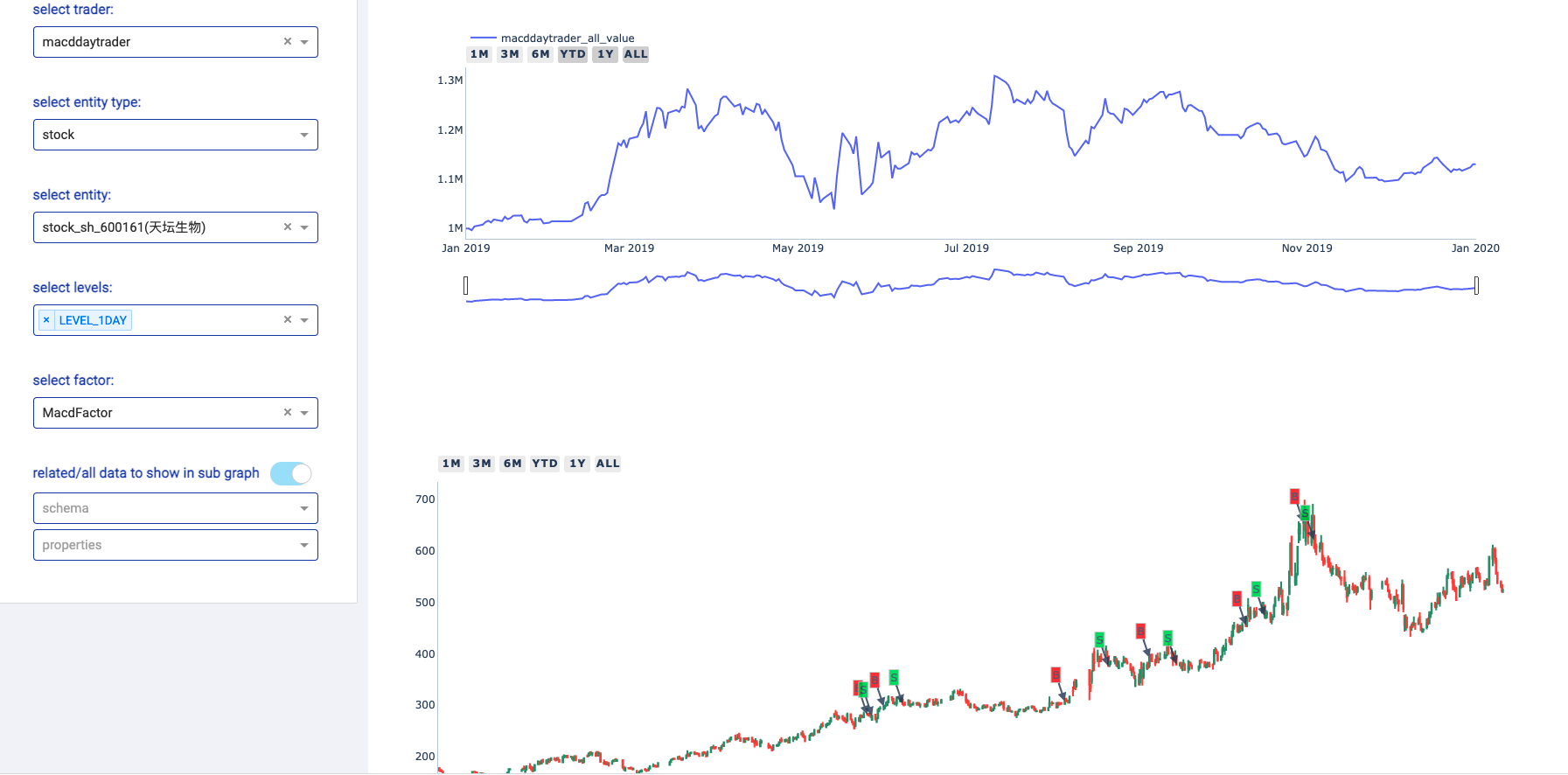

Dash & Plotly UI

It's good for backtest and research, but it is not applicable for real-time market data and user interaction.

After the installation is complete, enter zvt on the command line

zvtThe example shown here relies on data, factor, trader, please read docs

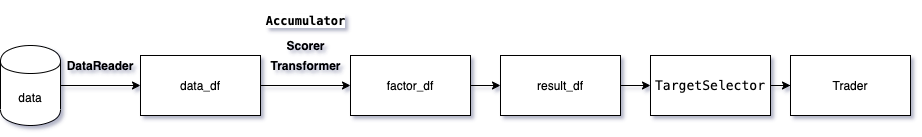

The core concept of the system is visual, and the name of the interface corresponds to it one-to-one, so it is also uniform and extensible.

You can write and run the strategy in your favorite ide, and then view its related targets, factor, signal and performance on the UI.

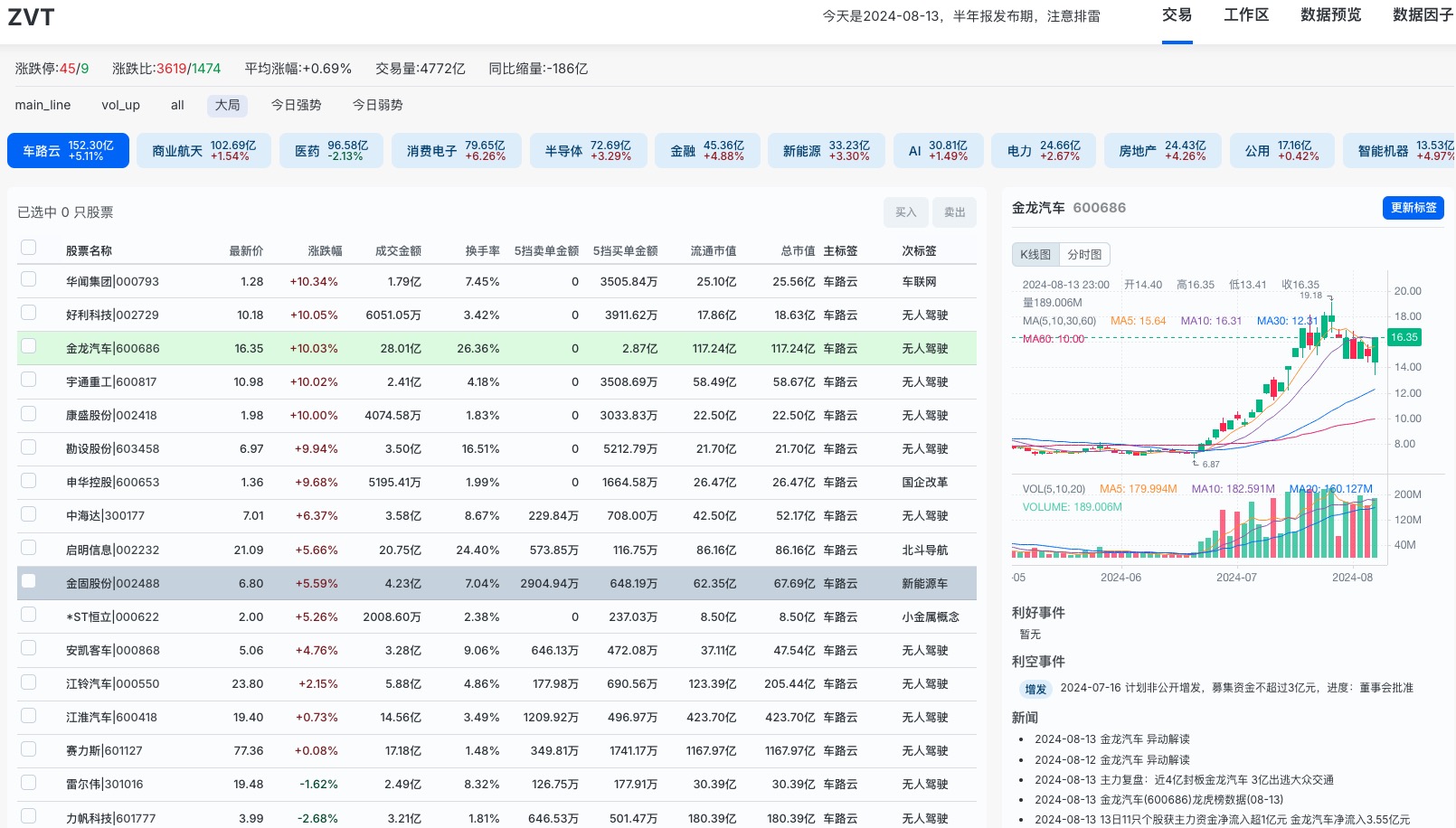

Rest api and standalone UI

It is more flexible and more scalable, more suitable for handling real-time market data and user interaction. Combined with the dynamic tag system provided by ZVT, it offers a trading approach that combines AI with human intervention.

- Init tag system

run following scripts:

https://github.com/zvtvz/zvt/blob/master/src/zvt/tasks/init_tag_system.py https://github.com/zvtvz/zvt/blob/master/src/zvt/tasks/stock_pool_runner.py https://github.com/zvtvz/zvt/blob/master/src/zvt/tasks/qmt_data_runner.py https://github.com/zvtvz/zvt/blob/master/src/zvt/tasks/qmt_tick_runner.py

- Install uvicorn

pip install uvicorn - Run zvt server

After the installation is complete, enter zvt_server on the command line

zvt_serverOr run it from source code: https://github.com/zvtvz/zvt/blob/master/src/zvt/zvt_server.py

- Check the api docs

open http://127.0.0.1:8090/docs

- Deploy the front end service

Front end source code: https://github.com/zvtvz/zvt_ui

Change the env file: https://github.com/zvtvz/zvt_ui/blob/main/.env

Set {your server IP} to zvt_server IP

NEXT_PUBLIC_SERVER = {your server IP}Then refer to the frontend's README to start the frontend service.

open http://127.0.0.1:3000/trade

Behold, the power of zvt:

>>> from zvt.domain import Stock, Stock1dHfqKdata

>>> from zvt.ml import MaStockMLMachine

>>> Stock.record_data(provider="em")

>>> entity_ids = ["stock_sz_000001", "stock_sz_000338", "stock_sh_601318"]

>>> Stock1dHfqKdata.record_data(provider="em", entity_ids=entity_ids, sleeping_time=1)

>>> machine = MaStockMLMachine(entity_ids=["stock_sz_000001"], data_provider="em")

>>> machine.train()

>>> machine.predict()

>>> machine.draw_result(entity_id="stock_sz_000001")

The few lines of code above has done: data capture, persistence, incremental update, machine learning, prediction, and display results. Once you are familiar with the core concepts of the system, you can apply it to any target in the market.

Data

China stock

>>> from zvt.domain import *

>>> Stock.record_data(provider="em")

>>> df = Stock.query_data(provider="em", index='code')

>>> print(df)

id entity_id timestamp entity_type exchange code name list_date end_date

code

000001 stock_sz_000001 stock_sz_000001 1991-04-03 stock sz 000001 平安银行 1991-04-03 None

000002 stock_sz_000002 stock_sz_000002 1991-01-29 stock sz 000002 万 科A 1991-01-29 None

000004 stock_sz_000004 stock_sz_000004 1990-12-01 stock sz 000004 国华网安 1990-12-01 None

000005 stock_sz_000005 stock_sz_000005 1990-12-10 stock sz 000005 世纪星源 1990-12-10 None

000006 stock_sz_000006 stock_sz_000006 1992-04-27 stock sz 000006 深振业A 1992-04-27 None

... ... ... ... ... ... ... ... ... ...

605507 stock_sh_605507 stock_sh_605507 2021-08-02 stock sh 605507 国邦医药 2021-08-02 None

605577 stock_sh_605577 stock_sh_605577 2021-08-24 stock sh 605577 龙版传媒 2021-08-24 None

605580 stock_sh_605580 stock_sh_605580 2021-08-19 stock sh 605580 恒盛能源 2021-08-19 None

605588 stock_sh_605588 stock_sh_605588 2021-08-12 stock sh 605588 冠石科技 2021-08-12 None

605589 stock_sh_605589 stock_sh_605589 2021-08-10 stock sh 605589 圣泉集团 2021-08-10 None

[4136 rows x 9 columns]USA stock

>>> Stockus.record_data()

>>> df = Stockus.query_data(index='code')

>>> print(df)

id entity_id timestamp entity_type exchange code name list_date end_date

code

A stockus_nyse_A stockus_nyse_A NaT stockus nyse A 安捷伦 None None

AA stockus_nyse_AA stockus_nyse_AA NaT stockus nyse AA 美国铝业 None None

AAC stockus_nyse_AAC stockus_nyse_AAC NaT stockus nyse AAC Ares Acquisition Corp-A None None

AACG stockus_nasdaq_AACG stockus_nasdaq_AACG NaT stockus nasdaq AACG ATA Creativity Global ADR None None

AACG stockus_nyse_AACG stockus_nyse_AACG NaT stockus nyse AACG ATA Creativity Global ADR None None

... ... ... ... ... ... ... ... ... ...

ZWRK stockus_nasdaq_ZWRK stockus_nasdaq_ZWRK NaT stockus nasdaq ZWRK Z-Work Acquisition Corp-A None None

ZY stockus_nasdaq_ZY stockus_nasdaq_ZY NaT stockus nasdaq ZY Zymergen Inc None None

ZYME stockus_nyse_ZYME stockus_nyse_ZYME NaT stockus nyse ZYME Zymeworks Inc None None

ZYNE stockus_nasdaq_ZYNE stockus_nasdaq_ZYNE NaT stockus nasdaq ZYNE Zynerba Pharmaceuticals Inc None None

ZYXI stockus_nasdaq_ZYXI stockus_nasdaq_ZYXI NaT stockus nasdaq ZYXI Zynex Inc None None

[5826 rows x 9 columns]

>>> Stockus.query_data(code='AAPL')

id entity_id timestamp entity_type exchange code name list_date end_date

0 stockus_nasdaq_AAPL stockus_nasdaq_AAPL None stockus nasdaq AAPL 苹果 None NoneHong Kong stock

>>> Stockhk.record_data()

>>> df = Stockhk.query_data(index='code')

>>> print(df)

id entity_id timestamp entity_type exchange code name list_date end_date

code

00001 stockhk_hk_00001 stockhk_hk_00001 NaT stockhk hk 00001 长和 None None

00002 stockhk_hk_00002 stockhk_hk_00002 NaT stockhk hk 00002 中电控股 None None

00003 stockhk_hk_00003 stockhk_hk_00003 NaT stockhk hk 00003 香港中华煤气 None None

00004 stockhk_hk_00004 stockhk_hk_00004 NaT stockhk hk 00004 九龙仓集团 None None

00005 stockhk_hk_00005 stockhk_hk_00005 NaT stockhk hk 00005 汇丰控股 None None

... ... ... ... ... ... ... ... ... ...

09996 stockhk_hk_09996 stockhk_hk_09996 NaT stockhk hk 09996 沛嘉医疗-B None None

09997 stockhk_hk_09997 stockhk_hk_09997 NaT stockhk hk 09997 康基医疗 None None

09998 stockhk_hk_09998 stockhk_hk_09998 NaT stockhk hk 09998 光荣控股 None None

09999 stockhk_hk_09999 stockhk_hk_09999 NaT stockhk hk 09999 网易-S None None

80737 stockhk_hk_80737 stockhk_hk_80737 NaT stockhk hk 80737 湾区发展-R None None

[2597 rows x 9 columns]

>>> df[df.code=='00700']

id entity_id timestamp entity_type exchange code name list_date end_date

2112 stockhk_hk_00700 stockhk_hk_00700 None stockhk hk 00700 腾讯控股 None None

And more

>>> from zvt.contract import *

>>> zvt_context.tradable_schema_map

{'stockus': zvt.domain.meta.stockus_meta.Stockus,

'stockhk': zvt.domain.meta.stockhk_meta.Stockhk,

'index': zvt.domain.meta.index_meta.Index,

'etf': zvt.domain.meta.etf_meta.Etf,

'stock': zvt.domain.meta.stock_meta.Stock,

'block': zvt.domain.meta.block_meta.Block,

'fund': zvt.domain.meta.fund_meta.Fund}The key is tradable entity type, and the value is the schema. The system provides unified record (record_data) and query (query_data) methods for the schema.

>>> Index.record_data()

>>> df=Index.query_data(filters=[Index.category=='scope',Index.exchange='sh'])

>>> print(df)

id entity_id timestamp entity_type exchange code name list_date end_date publisher category base_point

0 index_sh_000001 index_sh_000001 1990-12-19 index sh 000001 上证指数 1991-07-15 None csindex scope 100.00

1 index_sh_000002 index_sh_000002 1990-12-19 index sh 000002 A股指数 1992-02-21 None csindex scope 100.00

2 index_sh_000003 index_sh_000003 1992-02-21 index sh 000003 B股指数 1992-08-17 None csindex scope 100.00

3 index_sh_000010 index_sh_000010 2002-06-28 index sh 000010 上证180 2002-07-01 None csindex scope 3299.06

4 index_sh_000016 index_sh_000016 2003-12-31 index sh 000016 上证50 2004-01-02 None csindex scope 1000.00

.. ... ... ... ... ... ... ... ... ... ... ... ...

25 index_sh_000020 index_sh_000020 2007-12-28 index sh 000020 中型综指 2008-05-12 None csindex scope 1000.00

26 index_sh_000090 index_sh_000090 2009-12-31 index sh 000090 上证流通 2010-12-02 None csindex scope 1000.00

27 index_sh_930903 index_sh_930903 2012-12-31 index sh 930903 中证A股 2016-10-18 None csindex scope 1000.00

28 index_sh_000688 index_sh_000688 2019-12-31 index sh 000688 科创50 2020-07-23 None csindex scope 1000.00

29 index_sh_931643 index_sh_931643 2019-12-31 index sh 931643 科创创业50 2021-06-01 None csindex scope 1000.00

[30 rows x 12 columns]

EntityEvent

We have tradable entity and then events about them.

Market quotes

the TradableEntity quote schema follows the following rules:

{entity_shema}{level}{adjust_type}Kdata- entity_schema

TradableEntity class,e.g., Stock,Stockus.

-

level

>>> for level in IntervalLevel: print(level.value) -

adjust type

>>> for adjust_type in AdjustType: print(adjust_type.value)

Note: In order to be compatible with historical data, the pre-reset is an exception, {adjust_type} is left empty

qfq

>>> Stock1dKdata.record_data(code='000338', provider='em')

>>> df = Stock1dKdata.query_data(code='000338', provider='em')

>>> print(df)

id entity_id timestamp provider code name level open close high low volume turnover change_pct turnover_rate

0 stock_sz_000338_2007-04-30 stock_sz_000338 2007-04-30 None 000338 潍柴动力 1d 2.33 2.00 2.40 1.87 207375.0 1.365189e+09 3.2472 0.1182

1 stock_sz_000338_2007-05-08 stock_sz_000338 2007-05-08 None 000338 潍柴动力 1d 2.11 1.94 2.20 1.87 86299.0 5.563198e+08 -0.0300 0.0492

2 stock_sz_000338_2007-05-09 stock_sz_000338 2007-05-09 None 000338 潍柴动力 1d 1.90 1.81 1.94 1.66 93823.0 5.782065e+08 -0.0670 0.0535

3 stock_sz_000338_2007-05-10 stock_sz_000338 2007-05-10 None 000338 潍柴动力 1d 1.78 1.85 1.98 1.75 47720.0 2.999226e+08 0.0221 0.0272

4 stock_sz_000338_2007-05-11 stock_sz_000338 2007-05-11 None 000338 潍柴动力 1d 1.81 1.73 1.81 1.66 39273.0 2.373126e+08 -0.0649 0.0224

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

3426 stock_sz_000338_2021-08-27 stock_sz_000338 2021-08-27 None 000338 潍柴动力 1d 19.39 20.30 20.30 19.25 1688497.0 3.370241e+09 0.0601 0.0398

3427 stock_sz_000338_2021-08-30 stock_sz_000338 2021-08-30 None 000338 潍柴动力 1d 20.30 20.09 20.31 19.78 1187601.0 2.377957e+09 -0.0103 0.0280

3428 stock_sz_000338_2021-08-31 stock_sz_000338 2021-08-31 None 000338 潍柴动力 1d 20.20 20.07 20.63 19.70 1143985.0 2.295195e+09 -0.0010 0.0270

3429 stock_sz_000338_2021-09-01 stock_sz_000338 2021-09-01 None 000338 潍柴动力 1d 19.98 19.68 19.98 19.15 1218697.0 2.383841e+09 -0.0194 0.0287

3430 stock_sz_000338_2021-09-02 stock_sz_000338 2021-09-02 None 000338 潍柴动力 1d 19.71 19.85 19.97 19.24 1023545.0 2.012006e+09 0.0086 0.0241

[3431 rows x 15 columns]

>>> Stockus1dKdata.record_data(code='AAPL', provider='em')

>>> df = Stockus1dKdata.query_data(code='AAPL', provider='em')

>>> print(df)

id entity_id timestamp provider code name level open close high low volume turnover change_pct turnover_rate

0 stockus_nasdaq_AAPL_1984-09-07 stockus_nasdaq_AAPL 1984-09-07 None AAPL 苹果 1d -5.59 -5.59 -5.58 -5.59 2981600.0 0.000000e+00 0.0000 0.0002

1 stockus_nasdaq_AAPL_1984-09-10 stockus_nasdaq_AAPL 1984-09-10 None AAPL 苹果 1d -5.59 -5.59 -5.58 -5.59 2346400.0 0.000000e+00 0.0000 0.0001

2 stockus_nasdaq_AAPL_1984-09-11 stockus_nasdaq_AAPL 1984-09-11 None AAPL 苹果 1d -5.58 -5.58 -5.58 -5.58 5444000.0 0.000000e+00 0.0018 0.0003

3 stockus_nasdaq_AAPL_1984-09-12 stockus_nasdaq_AAPL 1984-09-12 None AAPL 苹果 1d -5.58 -5.59 -5.58 -5.59 4773600.0 0.000000e+00 -0.0018 0.0003

4 stockus_nasdaq_AAPL_1984-09-13 stockus_nasdaq_AAPL 1984-09-13 None AAPL 苹果 1d -5.58 -5.58 -5.58 -5.58 7429600.0 0.000000e+00 0.0018 0.0004

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

8765 stockus_nasdaq_AAPL_2021-08-27 stockus_nasdaq_AAPL 2021-08-27 None AAPL 苹果 1d 147.48 148.60 148.75 146.83 55802388.0 8.265452e+09 0.0072 0.0034

8766 stockus_nasdaq_AAPL_2021-08-30 stockus_nasdaq_AAPL 2021-08-30 None AAPL 苹果 1d 149.00 153.12 153.49 148.61 90956723.0 1.383762e+10 0.0304 0.0055

8767 stockus_nasdaq_AAPL_2021-08-31 stockus_nasdaq_AAPL 2021-08-31 None AAPL 苹果 1d 152.66 151.83 152.80 151.29 86453117.0 1.314255e+10 -0.0084 0.0052

8768 stockus_nasdaq_AAPL_2021-09-01 stockus_nasdaq_AAPL 2021-09-01 None AAPL 苹果 1d 152.83 152.51 154.98 152.34 80313711.0 1.235321e+10 0.0045 0.0049

8769 stockus_nasdaq_AAPL_2021-09-02 stockus_nasdaq_AAPL 2021-09-02 None AAPL 苹果 1d 153.87 153.65 154.72 152.40 71171317.0 1.093251e+10 0.0075 0.0043

[8770 rows x 15 columns]hfq

>>> Stock1dHfqKdata.record_data(code='000338', provider='em')

>>> df = Stock1dHfqKdata.query_data(code='000338', provider='em')

>>> print(df)

id entity_id timestamp provider code name level open close high low volume turnover change_pct turnover_rate

0 stock_sz_000338_2007-04-30 stock_sz_000338 2007-04-30 None 000338 潍柴动力 1d 70.00 64.93 71.00 62.88 207375.0 1.365189e+09 2.1720 0.1182

1 stock_sz_000338_2007-05-08 stock_sz_000338 2007-05-08 None 000338 潍柴动力 1d 66.60 64.00 68.00 62.88 86299.0 5.563198e+08 -0.0143 0.0492

2 stock_sz_000338_2007-05-09 stock_sz_000338 2007-05-09 None 000338 潍柴动力 1d 63.32 62.00 63.88 59.60 93823.0 5.782065e+08 -0.0313 0.0535

3 stock_sz_000338_2007-05-10 stock_sz_000338 2007-05-10 None 000338 潍柴动力 1d 61.50 62.49 64.48 61.01 47720.0 2.999226e+08 0.0079 0.0272

4 stock_sz_000338_2007-05-11 stock_sz_000338 2007-05-11 None 000338 潍柴动力 1d 61.90 60.65 61.90 59.70 39273.0 2.373126e+08 -0.0294 0.0224

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

3426 stock_sz_000338_2021-08-27 stock_sz_000338 2021-08-27 None 000338 潍柴动力 1d 331.97 345.95 345.95 329.82 1688497.0 3.370241e+09 0.0540 0.0398

3427 stock_sz_000338_2021-08-30 stock_sz_000338 2021-08-30 None 000338 潍柴动力 1d 345.95 342.72 346.10 337.96 1187601.0 2.377957e+09 -0.0093 0.0280

3428 stock_sz_000338_2021-08-31 stock_sz_000338 2021-08-31 None 000338 潍柴动力 1d 344.41 342.41 351.02 336.73 1143985.0 2.295195e+09 -0.0009 0.0270

3429 stock_sz_000338_2021-09-01 stock_sz_000338 2021-09-01 None 000338 潍柴动力 1d 341.03 336.42 341.03 328.28 1218697.0 2.383841e+09 -0.0175 0.0287

3430 stock_sz_000338_2021-09-02 stock_sz_000338 2021-09-02 None 000338 潍柴动力 1d 336.88 339.03 340.88 329.67 1023545.0 2.012006e+09 0.0078 0.0241

[3431 rows x 15 columns]Finance factor

>>> FinanceFactor.record_data(code='000338')

>>> FinanceFactor.query_data(code='000338',columns=FinanceFactor.important_cols(),index='timestamp')

basic_eps total_op_income net_profit op_income_growth_yoy net_profit_growth_yoy roe rota gross_profit_margin net_margin timestamp

timestamp

2002-12-31 NaN 1.962000e+07 2.471000e+06 NaN NaN NaN NaN 0.2068 0.1259 2002-12-31

2003-12-31 1.27 3.574000e+09 2.739000e+08 181.2022 109.8778 0.7729 0.1783 0.2551 0.0766 2003-12-31

2004-12-31 1.75 6.188000e+09 5.369000e+08 0.7313 0.9598 0.3245 0.1474 0.2489 0.0868 2004-12-31

2005-12-31 0.93 5.283000e+09 3.065000e+08 -0.1463 -0.4291 0.1327 0.0603 0.2252 0.0583 2005-12-31

2006-03-31 0.33 1.859000e+09 1.079000e+08 NaN NaN NaN NaN NaN 0.0598 2006-03-31

... ... ... ... ... ... ... ... ... ... ...

2020-08-28 0.59 9.449000e+10 4.680000e+09 0.0400 -0.1148 0.0983 0.0229 0.1958 0.0603 2020-08-28

2020-10-31 0.90 1.474000e+11 7.106000e+09 0.1632 0.0067 0.1502 0.0347 0.1949 0.0590 2020-10-31

2021-03-31 1.16 1.975000e+11 9.207000e+09 0.1327 0.0112 0.1919 0.0444 0.1931 0.0571 2021-03-31

2021-04-30 0.42 6.547000e+10 3.344000e+09 0.6788 0.6197 0.0622 0.0158 0.1916 0.0667 2021-04-30

2021-08-31 0.80 1.264000e+11 6.432000e+09 0.3375 0.3742 0.1125 0.0287 0.1884 0.0653 2021-08-31

[66 rows x 10 columns]Three financial tables

>>> BalanceSheet.record_data(code='000338')

>>> IncomeStatement.record_data(code='000338')

>>> CashFlowStatement.record_data(code='000338')And more

>>> zvt_context.schemas

[zvt.domain.dividend_financing.DividendFinancing,

zvt.domain.dividend_financing.DividendDetail,

zvt.domain.dividend_financing.SpoDetail...]All schemas is registered in zvt_context.schemas, schema is table, data structure. The fields and meaning could be checked in following ways:

- help

type the schema. and press tab to show its fields or .help()

>>> FinanceFactor.help()- source code

Schemas defined in domain

From above examples, you should know the unified way of recording data:

Schema.record_data(provider='your provider',codes='the codes')

Note the optional parameter provider, which represents the data provider. A schema can have multiple providers, which is the cornerstone of system stability.

Check the provider has been implemented:

>>> Stock.provider_map_recorder

{'joinquant': zvt.recorders.joinquant.meta.jq_stock_meta_recorder.JqChinaStockRecorder,

'exchange': zvt.recorders.exchange.exchange_stock_meta_recorder.ExchangeStockMetaRecorder,

'em': zvt.recorders.em.meta.em_stock_meta_recorder.EMStockRecorder,

'eastmoney': zvt.recorders.eastmoney.meta.eastmoney_stock_meta_recorder.EastmoneyChinaStockListRecorder}

You can use any provider to get the data, the first one is used by default.

One more example, the stock sector data recording:

>>> Block.provider_map_recorder

{'eastmoney': zvt.recorders.eastmoney.meta.eastmoney_block_meta_recorder.EastmoneyChinaBlockRecorder,

'sina': zvt.recorders.sina.meta.sina_block_recorder.SinaBlockRecorder}

>>> Block.record_data(provider='sina')

Block registered recorders:{'eastmoney': <class 'zvt.recorders.eastmoney.meta.china_stock_category_recorder.EastmoneyChinaBlockRecorder'>, 'sina': <class 'zvt.recorders.sina.meta.sina_china_stock_category_recorder.SinaChinaBlockRecorder'>}

2020-03-04 23:56:48,931 INFO MainThread finish record sina blocks:industry

2020-03-04 23:56:49,450 INFO MainThread finish record sina blocks:conceptLearn more about record_data

- The parameter code[single], codes[multiple] represent the stock codes to be recorded

- Recording the whole market if not set code, codes

- This method will store the data locally and only do incremental updates

Refer to the scheduling recoding waydata runner

Market-wide stock selection

After recording the data of the whole market, you can quickly query the required data locally.

An example: the top 20 stocks with roe>8% and revenue growth>8% in the 2018 annual report

>>> df=FinanceFactor.query_data(filters=[FinanceFactor.roe>0.08,FinanceFactor.report_period=='year',FinanceFactor.op_income_growth_yoy>0.08],start_timestamp='2019-01-01',order=FinanceFactor.roe.desc(),limit=20,columns=["code"]+FinanceFactor.important_cols(),index='code')

code basic_eps total_op_income net_profit op_income_growth_yoy net_profit_growth_yoy roe rota gross_profit_margin net_margin timestamp

code

000048 000048 2.7350 4.919000e+09 1.101000e+09 0.4311 1.5168 0.7035 0.1988 0.5243 0.2355 2020-04-30

000912 000912 0.3500 4.405000e+09 3.516000e+08 0.1796 1.2363 4.7847 0.0539 0.2175 0.0795 2019-03-20

002207 002207 0.2200 3.021000e+08 5.189000e+07 0.1600 1.1526 1.1175 0.1182 0.1565 0.1718 2020-04-27

002234 002234 5.3300 3.276000e+09 1.610000e+09 0.8023 3.2295 0.8361 0.5469 0.5968 0.4913 2020-04-21

002458 002458 3.7900 3.584000e+09 2.176000e+09 1.4326 4.9973 0.8318 0.6754 0.6537 0.6080 2020-02-20

... ... ... ... ... ... ... ... ... ... ... ...

600701 600701 -3.6858 7.830000e+08 -3.814000e+09 1.3579 -0.0325 1.9498 -0.7012 0.4173 -4.9293 2020-04-29

600747 600747 -1.5600 3.467000e+08 -2.290000e+09 2.1489 -0.4633 3.1922 -1.5886 0.0378 -6.6093 2020-06-30

600793 600793 1.6568 1.293000e+09 1.745000e+08 0.1164 0.8868 0.7490 0.0486 0.1622 0.1350 2019-04-30

600870 600870 0.0087 3.096000e+07 4.554000e+06 0.7773 1.3702 0.7458 0.0724 0.2688 0.1675 2019-03-30

688169 688169 15.6600 4.205000e+09 7.829000e+08 0.3781 1.5452 0.7172 0.4832 0.3612 0.1862 2020-04-28

[20 rows x 11 columns]So, you should be able to answer the following three questions now:

- What data is there?

- How to record data?

- How to query data?

For more advanced usage and extended data, please refer to the data section in the detailed document.

Write strategy

Now we could write strategy basing on TradableEntity and EntityEvent. The so-called strategy backtesting is nothing but repeating the following process:

At a certain time, find the targets which matching conditions, buy and sell them, and see the performance.

Two modes to write strategy:

- solo (free style)

At a certain time, calculate conditions according to the events, buy and sell

- formal

The calculation model of the two-dimensional index and multi-entity

a too simple,sometimes naive person (solo)

Well, this strategy is really too simple,sometimes naive, as we do most of the time.

When the report comes out, I look at the report. If the institution increases its position by more than 5%, I will buy it, and if the institution reduces its position by more than 50%, I will sell it.

Show you the code:

# -*- coding: utf-8 -*-

import pandas as pd

from zvt.api import get_recent_report_date

from zvt.contract import ActorType, AdjustType

from zvt.domain import StockActorSummary, Stock1dKdata

from zvt.trader import StockTrader

from zvt.utils import pd_is_not_null, is_same_date, to_pd_timestamp

class FollowIITrader(StockTrader):

finish_date = None

def on_time(self, timestamp: pd.Timestamp):

recent_report_date = to_pd_timestamp(get_recent_report_date(timestamp))

if self.finish_date and is_same_date(recent_report_date, self.finish_date):

return

filters = [StockActorSummary.actor_type == ActorType.raised_fund.value,

StockActorSummary.report_date == recent_report_date]

if self.entity_ids:

filters = filters + [StockActorSummary.entity_id.in_(self.entity_ids)]

df = StockActorSummary.query_data(filters=filters)

if pd_is_not_null(df):

self.logger.info(f'{df}')

self.finish_date = recent_report_date

long_df = df[df['change_ratio'] > 0.05]

short_df = df[df['change_ratio'] < -0.5]

try:

self.trade_the_targets(due_timestamp=timestamp, happen_timestamp=timestamp,

long_selected=set(long_df['entity_id'].to_list()),

short_selected=set(short_df['entity_id'].to_list()))

except Exception as e:

self.logger.error(e)

if __name__ == '__main__':

entity_id = 'stock_sh_600519'

Stock1dKdata.record_data(entity_id=entity_id, provider='em')

StockActorSummary.record_data(entity_id=entity_id, provider='em')

FollowIITrader(start_timestamp='2002-01-01', end_timestamp='2021-01-01', entity_ids=[entity_id],

provider='em', adjust_type=AdjustType.qfq, profit_threshold=None).run()So, writing a strategy is not that complicated. Just use your imagination, find the relation of the price and the events.

Then refresh http://127.0.0.1:8050/,check the performance of your strategy.

More examples is in Strategy example

Be serious (formal)

Simple calculation can be done through query_data. Now it's time to introduce the two-dimensional index multi-entity calculation model.

Takes technical factors as an example to illustrate the calculation process:

In [7]: from zvt.factors.technical_factor import *

In [8]: factor = BullFactor(codes=['000338','601318'],start_timestamp='2019-01-01',end_timestamp='2019-06-10', transformer=MacdTransformer())data_df

two-dimensional index DataFrame read from the schema by query_data.

In [11]: factor.data_df

Out[11]:

level high id entity_id open low timestamp close

entity_id timestamp

stock_sh_601318 2019-01-02 1d 54.91 stock_sh_601318_2019-01-02 stock_sh_601318 54.78 53.70 2019-01-02 53.94

2019-01-03 1d 55.06 stock_sh_601318_2019-01-03 stock_sh_601318 53.91 53.82 2019-01-03 54.42

2019-01-04 1d 55.71 stock_sh_601318_2019-01-04 stock_sh_601318 54.03 53.98 2019-01-04 55.31

2019-01-07 1d 55.88 stock_sh_601318_2019-01-07 stock_sh_601318 55.80 54.64 2019-01-07 55.03

2019-01-08 1d 54.83 stock_sh_601318_2019-01-08 stock_sh_601318 54.79 53.96 2019-01-08 54.54

... ... ... ... ... ... ... ... ...

stock_sz_000338 2019-06-03 1d 11.04 stock_sz_000338_2019-06-03 stock_sz_000338 10.93 10.74 2019-06-03 10.81

2019-06-04 1d 10.85 stock_sz_000338_2019-06-04 stock_sz_000338 10.84 10.57 2019-06-04 10.73

2019-06-05 1d 10.92 stock_sz_000338_2019-06-05 stock_sz_000338 10.87 10.59 2019-06-05 10.59

2019-06-06 1d 10.71 stock_sz_000338_2019-06-06 stock_sz_000338 10.59 10.49 2019-06-06 10.65

2019-06-10 1d 11.05 stock_sz_000338_2019-06-10 stock_sz_000338 10.73 10.71 2019-06-10 11.02

[208 rows x 8 columns]factor_df

two-dimensional index DataFrame which calculating using data_df by transformer e.g., MacdTransformer.

In [12]: factor.factor_df

Out[12]:

level high id entity_id open low timestamp close diff dea macd

entity_id timestamp

stock_sh_601318 2019-01-02 1d 54.91 stock_sh_601318_2019-01-02 stock_sh_601318 54.78 53.70 2019-01-02 53.94 NaN NaN NaN

2019-01-03 1d 55.06 stock_sh_601318_2019-01-03 stock_sh_601318 53.91 53.82 2019-01-03 54.42 NaN NaN NaN

2019-01-04 1d 55.71 stock_sh_601318_2019-01-04 stock_sh_601318 54.03 53.98 2019-01-04 55.31 NaN NaN NaN

2019-01-07 1d 55.88 stock_sh_601318_2019-01-07 stock_sh_601318 55.80 54.64 2019-01-07 55.03 NaN NaN NaN

2019-01-08 1d 54.83 stock_sh_601318_2019-01-08 stock_sh_601318 54.79 53.96 2019-01-08 54.54 NaN NaN NaN

... ... ... ... ... ... ... ... ... ... ... ...

stock_sz_000338 2019-06-03 1d 11.04 stock_sz_000338_2019-06-03 stock_sz_000338 10.93 10.74 2019-06-03 10.81 -0.121336 -0.145444 0.048215

2019-06-04 1d 10.85 stock_sz_000338_2019-06-04 stock_sz_000338 10.84 10.57 2019-06-04 10.73 -0.133829 -0.143121 0.018583

2019-06-05 1d 10.92 stock_sz_000338_2019-06-05 stock_sz_000338 10.87 10.59 2019-06-05 10.59 -0.153260 -0.145149 -0.016223

2019-06-06 1d 10.71 stock_sz_000338_2019-06-06 stock_sz_000338 10.59 10.49 2019-06-06 10.65 -0.161951 -0.148509 -0.026884

2019-06-10 1d 11.05 stock_sz_000338_2019-06-10 stock_sz_000338 10.73 10.71 2019-06-10 11.02 -0.137399 -0.146287 0.017776

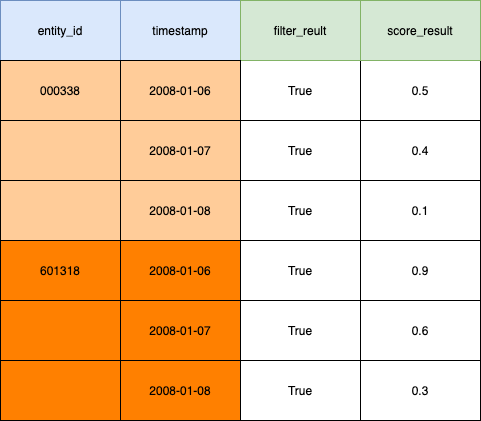

[208 rows x 11 columns]result_df

two-dimensional index DataFrame which calculating using factor_df or(and) data_df. It's used by TargetSelector.

e.g.,macd

In [14]: factor.result_df

Out[14]:

filter_result

entity_id timestamp

stock_sh_601318 2019-01-02 False

2019-01-03 False

2019-01-04 False

2019-01-07 False

2019-01-08 False

... ...

stock_sz_000338 2019-06-03 False

2019-06-04 False

2019-06-05 False

2019-06-06 False

2019-06-10 False

[208 rows x 1 columns]The format of result_df is as follows:

filter_result is True or False, score_result is from 0 to 1

Combining the stock picker and backtesting, the whole process is as follows:

Env settings(optional)

>>> from zvt import *

>>> zvt_env

{'zvt_home': '/Users/foolcage/zvt-home',

'data_path': '/Users/foolcage/zvt-home/data',

'tmp_path': '/Users/foolcage/zvt-home/tmp',

'ui_path': '/Users/foolcage/zvt-home/ui',

'log_path': '/Users/foolcage/zvt-home/logs'}

>>> zvt_config - jq_username 聚宽数据用户名

- jq_password 聚宽数据密码

- smtp_host 邮件服务器host

- smtp_port 邮件服务器端口

- email_username smtp邮箱账户

- email_password smtp邮箱密码

- wechat_app_id

- wechat_app_secrect

>>> init_config(current_config=zvt_config, jq_username='xxx', jq_password='yyy')config others this way: init_config(current_config=zvt_config, **kv)

History data

ZVT supports incremental data updates, and sharing historical data among users is encouraged for time-saving efficiency

Data providers

The new UI's real-time quotes are based on the QMT data source. To obtain access, please contact the author.

the data could be updated from different provider, this make the system stable.

add other providers, Data extension tutorial

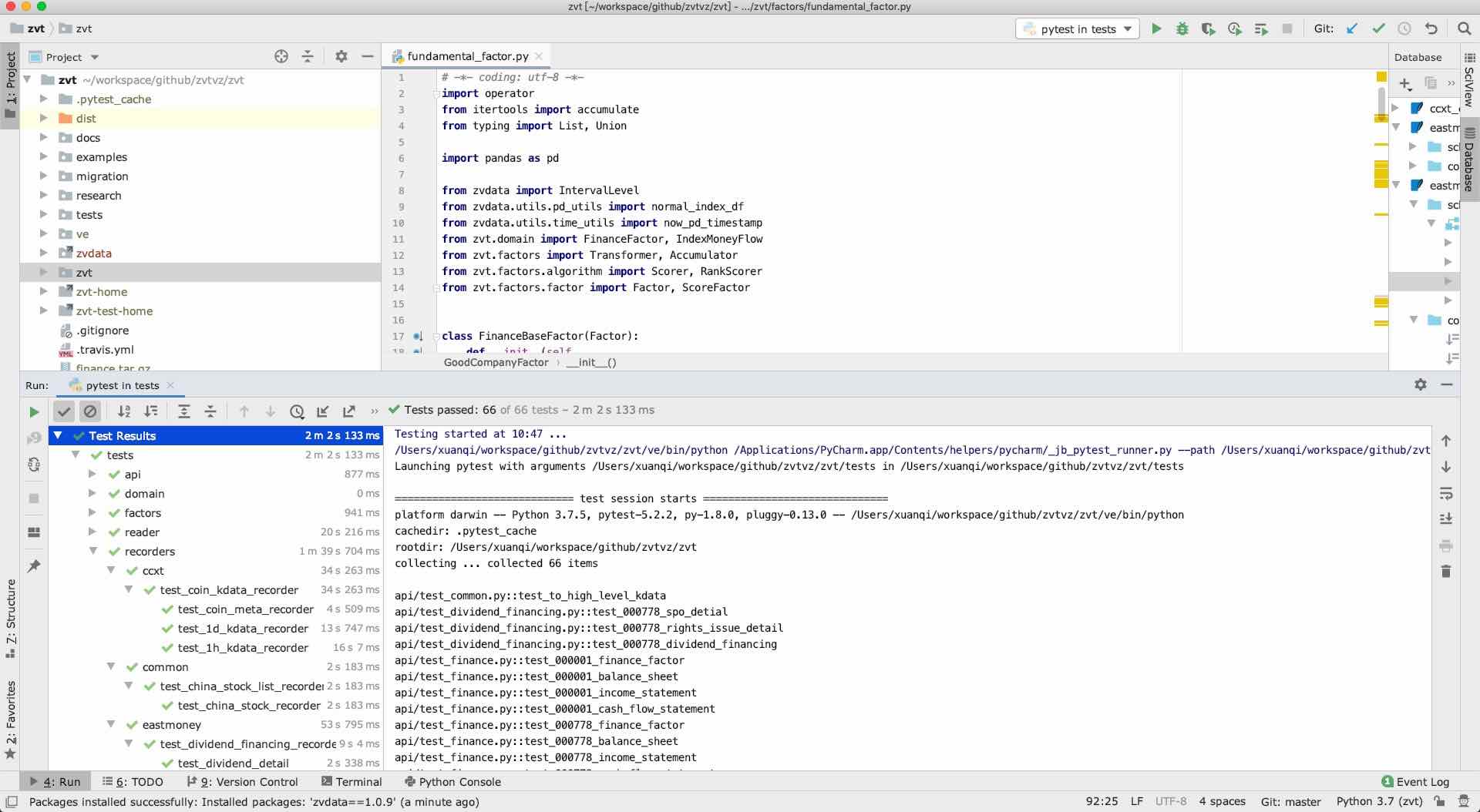

Development

Clone

git clone https://github.com/zvtvz/zvt.gitset up virtual env(python>=3.8),install requirements

pip3 install -r requirements.txt

pip3 install pytestTests

pytest ./tests --ignore=tests/recorders/

Most of the features can be referenced from the tests

Contribution

- Pass all unit tests, if it is a new feature, please add a new unit test for it

- Compliance with development specifications

- If necessary, please update the corresponding document

Developers are also very welcome to provide more examples for zvt, and work together to improve the documentation.

Buy me a coffee

Contact

wechat:foolcage

wechat subscription:

zhihu:

https://zhuanlan.zhihu.com/automoney